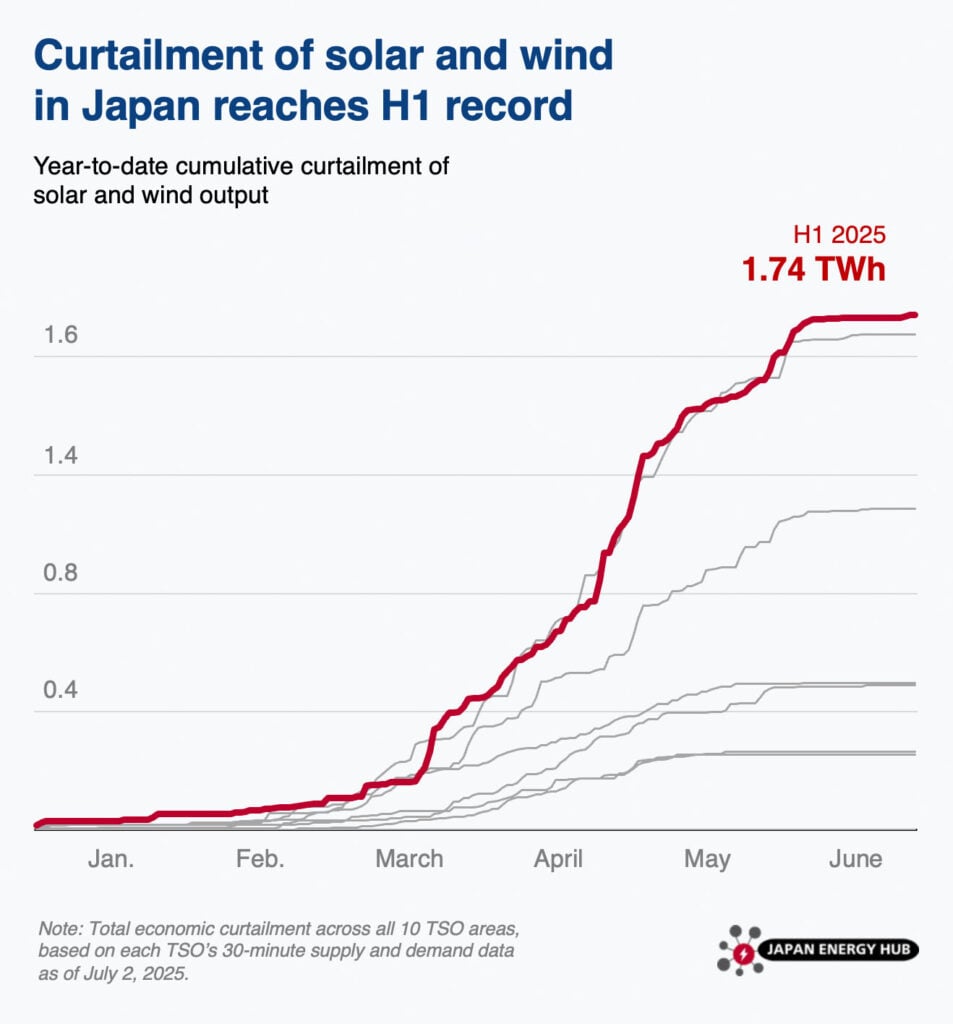

Solar and wind curtailment totaled 1.74TWh across Japan between January and June 2025 based on TSOs’ preliminary data, reaching a new high for the first half of a calendar year. Additionally, in Q1 FY2025, record volumes for the quarter were curtailed, exceeding METI’s full fiscal year forecast in multiple areas.

The H1 2025 total was 4% higher than the 1.68TWh in H1 2023, the previous record half-year. Curtailment in Kyushu, historically the most affected region, fell 24% from 1.13TWh to 863.4GWh between the first halves of 2023 and 2025. However, it has increased significantly in several other regions as best demonstrated by Q1 FY2025 results.

Between April and June 2025, solar and wind curtailment set records for the quarter in Hokkaido, Tohoku, Chubu, and Shikoku. It also exceeded METI’s full fiscal year, April 2025 to March 2026 forecast released in January 2025 in three areas, including Tohoku, Chubu, and Kansai.

Curtailment in calendar Q3, which also includes the summer peak demand season, and Q4 is typically low, having accounted for 1% and 11% of the total between 2018 and 2024, respectively. However, Q1 curtailment, which accounted for 23% of the same historic total, may push Shikoku, which stood at 92% of the full FY2025 forecast as of the end of June 2025, and potentially other areas above METI’s projections.

Longer term, curtailment is likely to increase as renewable capacity grows and nuclear power plant restarts proceed. The trend is prompting feed-in-tariff (FIT) asset owners to consider conversion to the feed-in-premium (FIP) scheme and co-location with battery storage to recover returns lost to curtailment.

Conversions to FIP are also expected to be driven by an upcoming change in renewable asset curtailment order that prioritizes dispatch of FIP and other non-FIT assets over FIT plants, which will increase FIT asset curtailment even further (covered in the October 2024 issue of The Japan Power Industry Executive).